Sunday, February 9, 2025

What Is a Chargeback? A Comprehensive Guide to Understanding Chargebacks and Their Time Limits

Understanding chargebacks is critical for both consumers and merchants. Disputes over card transactions have become more common—and costly. In this guide, we’ll explore what a chargeback is, why it matters, the typical process behind it, and importantly, what is the time limit for a chargeback.

What Is a Chargeback?

A chargeback is the reversal of a credit or debit card transaction that occurs when a cardholder disputes a charge. In essence, when a customer questions a transaction, the card issuer reviews the case and may refund the disputed amount directly to the customer. This process is designed to protect consumers from fraudulent or erroneous charges.

Key Points:

- Dispute Initiation: The process begins when a customer contacts their card issuer to dispute a transaction.

- Review Process: The card issuer assesses the claim by gathering details from the customer, merchant, and card network.

- Refund Outcome: If the dispute is found to be valid, the customer receives a refund—this is the chargeback.

Common Reasons for Chargebacks

Understanding why chargebacks occur can help merchants minimize them. The most common reasons include:

- Fraudulent Transactions: Unauthorized use of a card, where someone other than the cardholder makes the purchase.

- Friendly Fraud: When the cardholder disputes a legitimate transaction, often due to confusion or a misunderstanding about the charge.

- Service or Product Issues: Customers sometimes use the chargeback process to resolve issues like delayed shipping, damaged products, or poor customer service—especially when they find it easier than contacting the merchant directly.

The Chargeback Process

The chargeback process is designed to protect consumers, but it can be time-consuming and costly for merchants. Here’s a high-level overview of the typical steps involved:

- Dispute Initiation: A customer contacts their card issuer to dispute a charge.

- Provisional Credit: The issuer provides the customer with a temporary credit while investigating the claim.

- Information Gathering: The card network collects all pertinent details about the disputed transaction.

- Merchant Notification: The acquiring bank informs the merchant about the dispute.

- Merchant Response: The merchant decides whether to accept the chargeback or contest it by submitting evidence.

- Evidence Review: The acquiring bank and the issuer review the evidence provided.

- Final Decision: The issuer makes a final decision—if the dispute is upheld, the customer keeps the refund; if not, the provisional credit is reversed.

What Is the Time Limit for a Chargeback?

One of the most important aspects of managing disputes is knowing the deadlines. What is the time limit for a chargeback? Generally, major card networks such as Visa and Mastercard require that chargebacks be initiated within 120 days from the transaction date. However, it’s important to note that:

- Variations by Dispute Type: Some types of disputes may have shorter or longer time limits depending on the specific circumstances and the card network’s policies.

- Issuer Policies: Individual banks or card issuers may have their own guidelines that can affect the dispute window.

- Prompt Action Is Crucial: For both consumers and merchants, acting quickly is essential. Customers should review their statements regularly and contact their issuer immediately if they notice any discrepancies.

Keeping these timelines in mind can help ensure that valid disputes are resolved before the deadline passes, protecting the interests of both consumers and merchants.

How Merchants and Issuers Can Prevent Chargebacks

Since chargebacks can be costly—impacting both revenue and operational costs—many merchants are looking for ways to prevent them. Here are some effective strategies:

- Enhance Transaction Clarity: Ensure that transaction descriptors on billing statements are clear. Using recognizable merchant names, logos, and detailed descriptions can reduce confusion that often leads to "friendly fraud."

- Improve Customer Service: Promptly address customer concerns about products or services. Clear communication can prevent many disputes from escalating to chargebacks.

- Use Real-Time Alert Systems: Some solutions allow merchants and issuers to share dispute information in real-time, which can help resolve issues before they become chargebacks.

- Streamline the Dispute Process: Implementing collaborative tools and technology (such as dispute resolution platforms) can reduce the administrative burden and speed up the resolution process.

Conclusion

Chargebacks serve as an important safeguard in the world of digital payments, protecting consumers from fraud and error. However, they can also present significant challenges for merchants, from lost revenue to added operational costs. By understanding what a chargeback is, knowing the time limits for initiating disputes, and implementing proactive strategies to prevent them, both merchants and card issuers can work together to reduce the impact of chargebacks.

Stay informed and proactive—whether you’re a consumer keeping an eye on your statements or a merchant striving to enhance customer satisfaction, knowing the ins and outs of chargebacks can help you navigate today’s dynamic payment landscape effectively.

Are you facing a chargeback?

You need a system. I can help.

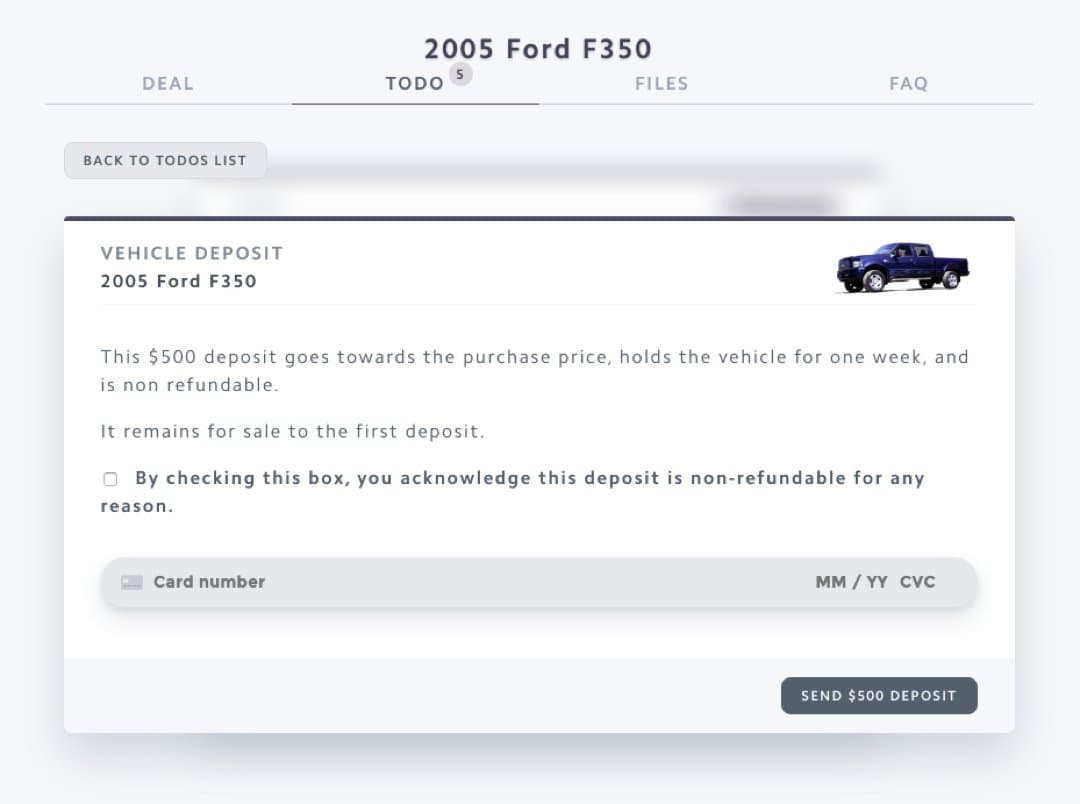

Terms of sale

You need the right UI/UX

If your user inferface does not have the right verbiage, it is very hard to win. I will help you set yourself up for success.

Stipulated facts

You need to think like an attorney

If the customer did not dispute a fact, consider it admitted. You need to state the unstated. I will help you shape your case to state the facts most favorable to you.

Argue harm

You need a theory of the case

The best way to win a chargeback is to show how you were harmed. I will help you build a case that shows how the chargeback was against terms and hurt your business.

Sanity

You need to stop thinking about it

Chargebacks can feel like theft and business is already stressful enough. Having a proven system ready to go will save your sanity. Respond with confidence in minutes and move on with your day.