Monday, February 10, 2025

Effective Terms of Service: How Merchants Can Prevent Chargebacks and Disputes

In today’s competitive market, merchants offering digital or physical products and services face an ever-present risk: chargebacks and credit card disputes. Clear, customer-friendly terms of service not only protect your business but also build trust with your customers and even help sway decisions in your favor during a dispute. In this post, we’ll explore actionable strategies for drafting effective terms that reduce the risk of chargebacks and credit card disputes—all while ensuring your services shine.

Why Clear Terms of Service Matter

Every merchant knows that a well-written terms of service (TOS) is more than a legal formality—it’s an essential communication tool. When customers understand exactly what they’re signing up for, misunderstandings and disputes diminish significantly. In the competitive world of merchant services, having transparent, easy-to-understand terms can mean the difference between a smooth transaction and a costly chargeback.

Instead of crafting legal jargon meant for courtroom battles, the advice is simple: write for your audience. In this case, your audience includes not only your customers but also the credit card issuers and chargeback agents who evaluate disputes.

The Four Pillars of Your Terms of Sale

According to the video transcript, your terms of sale should clearly outline four main elements:

What’s Being Sold

- Product Scope: Clearly describe your product or service. For digital products, specify the purchase tiers, features included, and what is excluded. This clarity helps manage customer expectations from the start.

Payment Terms

- Pricing Details: Outline how taxes, shipping, and any recurring charges (like subscriptions) are applied. Being upfront about payment details minimizes confusion and future disputes.

Guarantees or Warranties

- Service Assurance: Explain any warranties or guarantees that come with your product or service. This reassurance can improve customer trust and satisfaction.

Refund Policy

- Dispute Prevention: Detail your refund policy clearly, especially if it includes non-refundable components. By explaining the rationale behind such policies, you provide chargeback agents with the context they need when disputes arise.

Tackling Chargebacks and Credit Card Disputes Head-On

One of the key challenges for any merchant is handling chargebacks effectively. Instead of leaving your policies open to misinterpretation, explain the reasoning behind each term—especially those likely to be contested, such as refund policies or auto-renewal clauses.

Real-World Examples

- SaaS Auto-Renewal:

Imagine you run a software-as-a-service platform that operates on a one-year contract with automatic renewals. Instead of merely stating that renewals are non-refundable, your terms might explain:By clearly explaining the economic rationale behind this policy, you help customers—and chargeback agents—understand why the non-refundable clause is in place.

"Unless we receive a cancellation notice on our website before your renewal date, our contract will automatically renew and your credit card will be charged. This policy ensures we can maintain dependable revenue, hire top talent, and provide you with exceptional service."

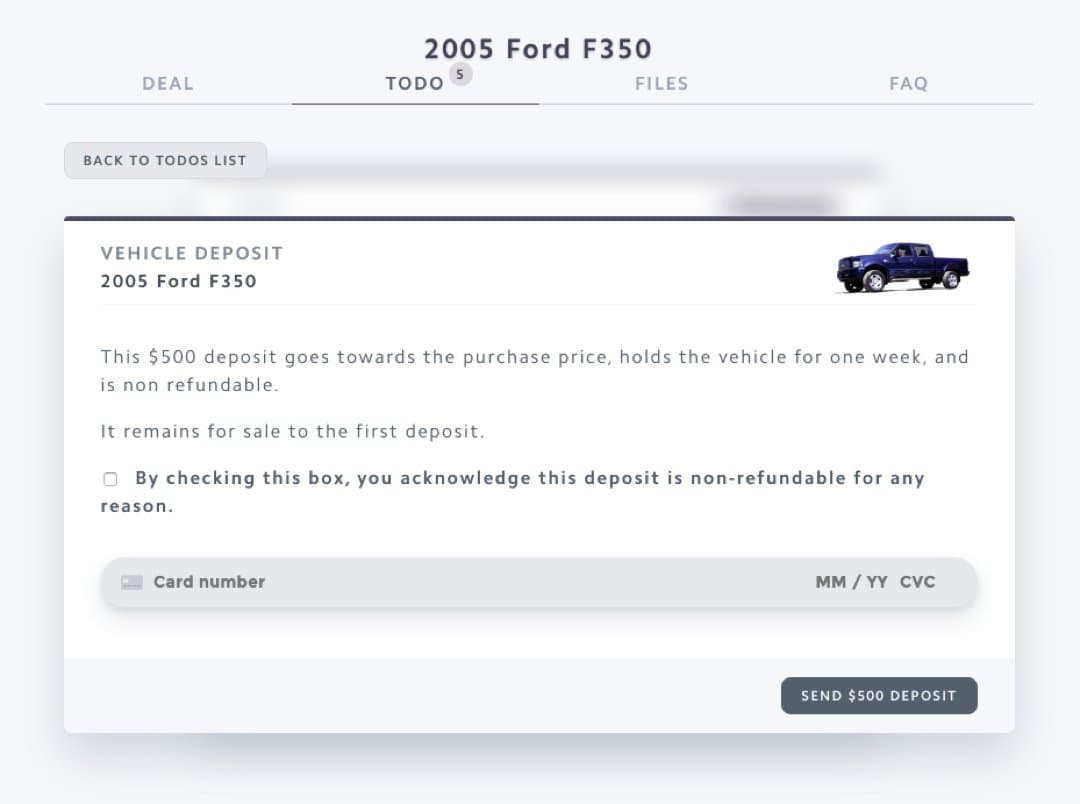

- Vehicle Options Contract:

Consider a merchant who charges a deposit for a used car. Rather than simply calling it a “non-refundable deposit,” reframing it as a “vehicle options contract” can reset customer expectations. You might write:Such clear language not only educates your customer but also provides compelling evidence during a chargeback dispute.

"The vehicle options contract is non-refundable to protect the vehicle's market value. Once an option contract is in place, the vehicle is removed from our active listings, ensuring that we provide a superior experience by maintaining accurate inventory and pricing integrity."

Best Practices for Drafting Customer-Friendly Terms

- Write for Your Audience:

Keep your language simple and direct. Avoid overly complex legal terminology that might alienate your customers or confuse a chargeback reviewer. - Include an Acknowledgment Checkbox:

Ensure that your customers actively acknowledge the terms of sale by including a checkbox during the checkout process. This simple step can strengthen your case in a dispute. - Explain Your Rationale:

For terms that deviate from industry norms—such as non-refundable deposits or auto-renewals—explain why these policies are in place. This transparency helps mitigate disputes when a credit card chargeback is filed. - Balance Clarity with Protection:

While it’s important to safeguard your business interests, remember that clear, customer-focused language builds trust. Avoid drafting terms solely for litigation purposes; instead, focus on creating a positive customer experience. - Consult an Attorney When Needed:

If your business involves complex transactions or if litigation is a concern, seek legal advice. While many merchants can benefit from straightforward explanations, professional guidance ensures you’re not inadvertently exposing your business to unnecessary risk.

Conclusion

For every merchant, the clarity of your terms of service is a powerful tool in preventing credit card disputes and chargebacks. By laying out what is sold, how payments work, and the specifics of warranties and refund policies in clear, plain language, you not only protect your services but also foster a transparent relationship with your customers. When a dispute arises, these well-crafted terms can help resolve issues quickly and in your favor.

By embracing these best practices and explaining the rationale behind each policy, your merchant services will be better equipped to win disputes, avoid unnecessary chargebacks, and maintain a reputation for excellent customer service.

Ready to update your terms of service? Take a moment to review your current policies and consider how clearer language and well-explained rationales can safeguard your business and enhance customer trust.

By focusing on clear communication and thoughtful policy design, you’re not just protecting your merchant business—you’re building lasting relationships with your customers and ensuring your services continue to thrive in a competitive market.

Are you facing a chargeback?

You need a system. I can help.

Terms of sale

You need the right UI/UX

If your user inferface does not have the right verbiage, it is very hard to win. I will help you set yourself up for success.

Stipulated facts

You need to think like an attorney

If the customer did not dispute a fact, consider it admitted. You need to state the unstated. I will help you shape your case to state the facts most favorable to you.

Argue harm

You need a theory of the case

The best way to win a chargeback is to show how you were harmed. I will help you build a case that shows how the chargeback was against terms and hurt your business.

Sanity

You need to stop thinking about it

Chargebacks can feel like theft and business is already stressful enough. Having a proven system ready to go will save your sanity. Respond with confidence in minutes and move on with your day.