Wednesday, February 12, 2025

Mastering Your Chargeback Response: A Merchant's Guide to Dispute

If you're a merchant, dealing with a chargeback can feel like navigating a labyrinth. A well-prepared response is critical—not just for protecting your bottom line, but also for maintaining the integrity of your services. In this post, I'll break down a clear, concise template for your chargeback response that can help you dispute credit card chargebacks effectively.

Why a Strong Chargeback Response Matters

When a customer initiates a chargeback, it challenges your credibility as a merchant and can lead to financial losses if not handled correctly. Remember, a chargeback isn’t just a refund request—it’s a formal dispute of the credit card transaction. In many cases, your detailed response can mean the difference between a successful dispute and a lost case.

Key Points to Consider:

- Stay Focused: Address the core issue without getting dragged into every minor detail mentioned by the customer.

- Keep It Concise: Aim for a two-page response. Brevity helps ensure that your argument is clear and digestible for the chargeback agent.

- Follow a Structured Template: A standardized response not only saves time but also increases your odds of winning the dispute.

The Essential Template for Your Chargeback Response

Below is a step-by-step guide and template structure to help you craft a compelling chargeback response:

1. Title and Case Identification

Start with a clear title:

- Title: “Chargeback Response – [Case Number]”

- Include the Case Number: This should appear on every page, ensuring that even if the pages become separated, the chargeback agent can easily link them together.

2. Response Opening

Your opening sets the tone. Clearly state your intention:

“This document is responsive to the above case charge number. The chargeback violates the cardholder’s agreement, and the following details explain why the chargeback must be reversed.”

This opening is direct and immediately informs the reader that your dispute is both factual and justified.

3. Factual Background

Provide a clear, concise account of what transpired:

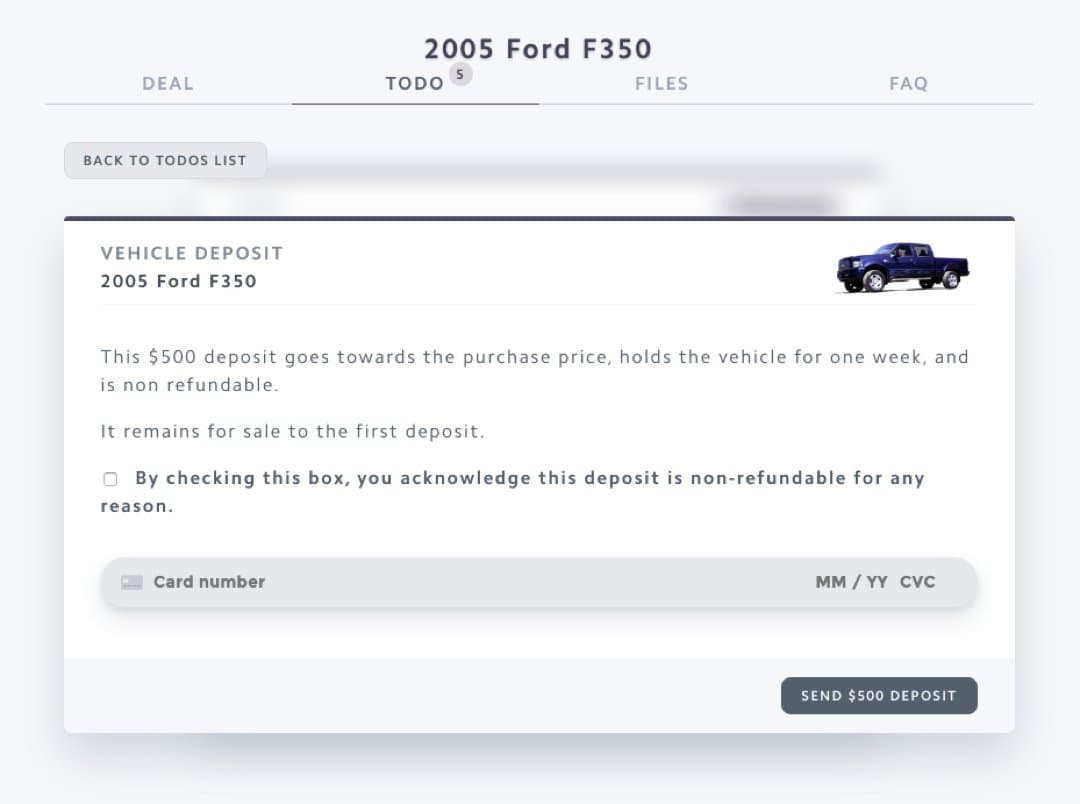

- Describe the Purchase: Explain what was purchased, how the terms of service were displayed, and include a brief quotation of these terms. For example, “By checking this box, you acknowledge and accept the terms of sale.”

- Evidence of Service Delivery: Mention what services were rendered (e.g., access to a digital product, assigned support agent, or provisioned extra resources).

- Customer's Objection Reframed: If the customer claims the service was defective, present the facts (e.g., “After using the product for 33 hours, the customer reported dissatisfaction after fully accessing the service.”)

4. Stipulated Facts

This section reinforces the unchallenged facts:

- State the Agreed Terms: For instance, “We both agree that the customer authorized the charge by checking the agreement box.”

- Highlight Service Usage: Emphasize that the customer enjoyed full access to the service, or in cases of defective merchandise, clarify that the issue was with the service, not with the product delivery.

By presenting three to five key stipulated facts, you make it difficult for the chargeback agent to dispute your claims.

5. Rationale for Dispute

Now, get into the heart of your dispute:

- Refer to Specific Terms: Clearly state the customer violated the mutually agreed terms. For example, “The customer used our service but initiated a chargeback on a non-refundable transaction.”

- Counter the Chargeback Code: Address why the specific credit card chargeback code doesn’t apply. If the dispute is for defective service, point out that the customer’s usage history contradicts this claim.

- Preemptive Counterarguments: If the customer might provide further justification, include a brief counterargument—but only if you’re certain. Avoid overcomplicating your response by arguing against points that haven't been raised yet.

6. Requested Outcome

Conclude with a precise, outcome-driven statement:

- Restate Your Main Points: Summarize why, taken as a whole, the evidence supports reversing the chargeback.

- State the Desired Resolution: Clearly request that the chargeback be reversed based on the facts and evidence provided.

For example, “Given that the customer fully utilized our non-refundable service for nearly 12 months, we respectfully request the immediate reversal of this chargeback.”

Best Practices for a Winning Chargeback Dispute

- Be Professional: Avoid getting emotional or drawn into unnecessary drama. Your goal is to present a legal, factual argument.

- Stay Within Time Limits: You typically have 30 days from the date of the chargeback to submit your response. Act promptly to safeguard your rights.

- Monitor the Process: Even after sending your response, keep an eye on the dispute status for up to 90 days. Both parties can request further arbitration if needed.

Conclusion

A meticulous chargeback response is not just about countering a credit card dispute—it’s about protecting your revenue and reinforcing the integrity of your merchant services. By following this structured template, you can shift the odds in your favor from a 15% win rate to well above 50%. And if you follow the link below, you can get my battle tested response that goes over 80%!

Use this guide to refine your response process, and remember: clear, concise, and fact-based communication is your best defense when disputing a chargeback.

Are you facing a chargeback?

You need a system. I can help.

Terms of sale

You need the right UI/UX

If your user inferface does not have the right verbiage, it is very hard to win. I will help you set yourself up for success.

Stipulated facts

You need to think like an attorney

If the customer did not dispute a fact, consider it admitted. You need to state the unstated. I will help you shape your case to state the facts most favorable to you.

Argue harm

You need a theory of the case

The best way to win a chargeback is to show how you were harmed. I will help you build a case that shows how the chargeback was against terms and hurt your business.

Sanity

You need to stop thinking about it

Chargebacks can feel like theft and business is already stressful enough. Having a proven system ready to go will save your sanity. Respond with confidence in minutes and move on with your day.